From World Trade to Wall Street

- Kylan Ross

- Apr 17, 2025

- 4 min read

On April 2nd, 2025, the day now known as 'Liberation Day' in America continues to roll out over the economy. 'Liberation Day,' famously known for Trump's address to renegotiate trade policy, sent Wall Street for a loop. I have had phone calls from friends and family members this week asking if they should sell and pull money out of the market. More on that later! As dreary as those few days were, something interesting happened just a week later. Trump pushed the pause button, calling for a 90-day halt on his proclaimed policies. As of last Saturday, April 12th, the White House said tariffs on the imports of Chinese-made smartphones and select electronics would not apply. So how do we go about this?

First, I can't begin to express the importance of not engaging in speculation. Arguably my favorite book ever written is 'The Intelligent Investor' by Benjamin Graham. Graham puts speculation this way: "An investment operation is one that, upon thorough analysis, promises safety of principal and an adequate return. Operations not meeting these requirements are speculative." Put simply, speculation is anything to do with gambling on price movements, guessing/predicting the future in the short-term momentum or hype. The bottom line is trading on emotion can be a dangerous game. Allowing fear to convince you to sell when prices drop or greed when buying into bubbles is all subject to speculative behavior. Speculation isn't evil, but it should be recognized for what it is. Speculation is when you bet on price, not necessarily the value of the market. True investment is based on solid analysis, safety of principal, and reasonable returns. This means that we view stocks as businesses with a long-term focus, disregarding short-term market fluctuations. In my post last week, I said one of the greatest things about our economy is that over the medium to long term, America flows up and to the right.

Two weeks ago when the tariff news broke out, you would've thought the sky was falling; it wasn't. Most wealth generated in this country comes from the years invested when there are bear markets. When prices drop, it not only creates an incentive for new entrants to engage in the markets but also a garage sale for future earnings to accrue. For the young person who has been looking at market prices, home prices, and gas/food prices since COVID, you should be thrilled that there has been churn in the markets during this time. The S&P 500 index has been up 141% since its low in March 2020. We need churn, we need disruption, and one of the blessings of engaging in downcycles and what history continues to show us is that there are good things coming ahead so long as you stay in the game. As of April 17th, 2025, the S&P 500 has declined approximately 10.2% year-to-date. Remember, it's been up 141% since COVID. Assuming you've been investing since then, you are up +130%. The index hit an all-time high of 6,144 earlier this year but has since retreated to around 5,275, a slowdown of 14% from the peak. It is understandable for the individuals who are closer to retirement age to have concern, and I don't want to minimize that.

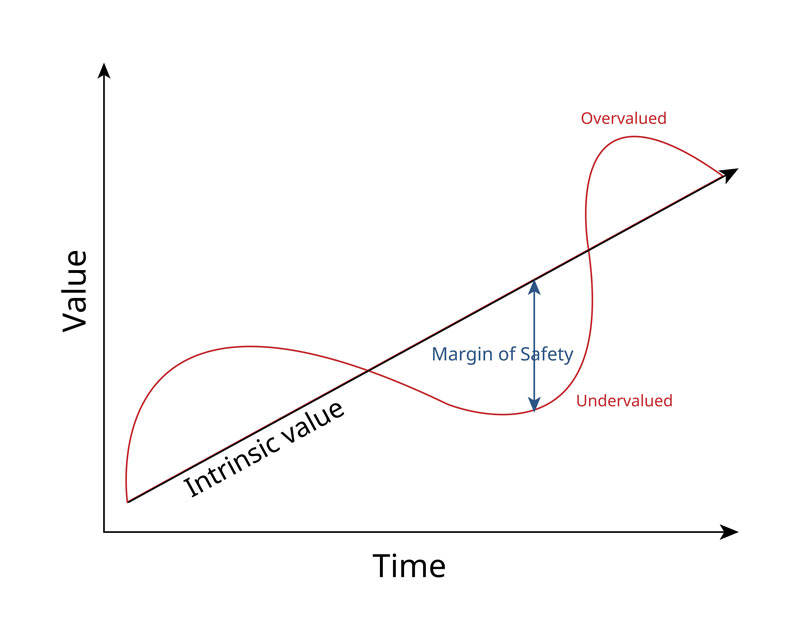

There's no question that recent market volatility has been attributed to trade tensions and the concern for economic growth. So what does an intelligent investor adhere to? This current climate underscores the importance of focusing on companies with strong fundamentals and consistent earnings and applying a margin of safety. As things get cheaper, begin to put smaller sums of money into the market. This is what Graham describes as a 'defensive investor.' Graham talks mostly about three different types of investors: speculative, defensive, and enterprising investors. I will break each of these down at a later time. For now, defensive investing is a form of diversification, and defense wins championships. In the short-term cycle throughout the history of tariffs, markets often drop immediately. Take the 'Smoot-Hawley Tariff Act of 1930,' where stocks were already falling after 1929 but really took a nosedive throughout the early 1930s as global trade fell about 66%. With tariffs, there are some unknowns, and if you ask me, the Trump administration has been giving the public little bite-sized pieces throughout these last few weeks, and it has businesses, small or large, wanting more answers. Here's what we know: tariffs historically make markets decline immediately as businesses often face higher costs, which affect their margins and drive up costs to their consumers. Profits often shrink, which leads to lower stock prices, and it's difficult to predict how our trade partners will respond (more often than not, it's retaliatory) in the short term. Sector-specific companies like tech, manufacturing, and agriculture typically get hit the hardest.

Okay, so is there any good news? Over longer periods, the market often softens, and businesses find a way to adjust. GDP growth may slow, and business profits could drop for a while. The good news is that trade policy rarely stays in a protectionist state for very long. As we develop domestically, the US will catch up in production and exporting around the world. We will be fine. If I dare to offer some wisdom, it would be this: don't panic about short-term movements. Take what Warren Buffett says: "Uncertainty is the friend of the buyer of long-term values." Recognize that high tariffs increase business risk, market volatility, profit margins, and uncertainty. Acknowledge that not putting any money into the market is an even bigger risk. In times like this, only invest in companies with strong balance sheets, consistent earnings (over a span of 10+ years), and reasonable valuations. Diversify to not become too concentrated with certain industries. Lastly, I would focus on what Graham calls a 'margin of safety,' meaning buying stocks well below their intrinsic value. This is your hedge, your playbook in uncertainty. I hope this helps.

Life is rich,

Kylan

Comments