'The names Bond'

- Kylan Ross

- Aug 14, 2025

- 4 min read

One of the first things investors should look at is paying close attention to what bonds are doing. What is common knowledge to investors is that bonds can often be seen as a safer approach to investment. Bond, after all, is a four-letter word. What is a huge misnomer around bonds is that they are often easier to understand and risk-averse. As intelligent investors, there is an equal and greater amount of diligence towards bond selection than most pay attention to.

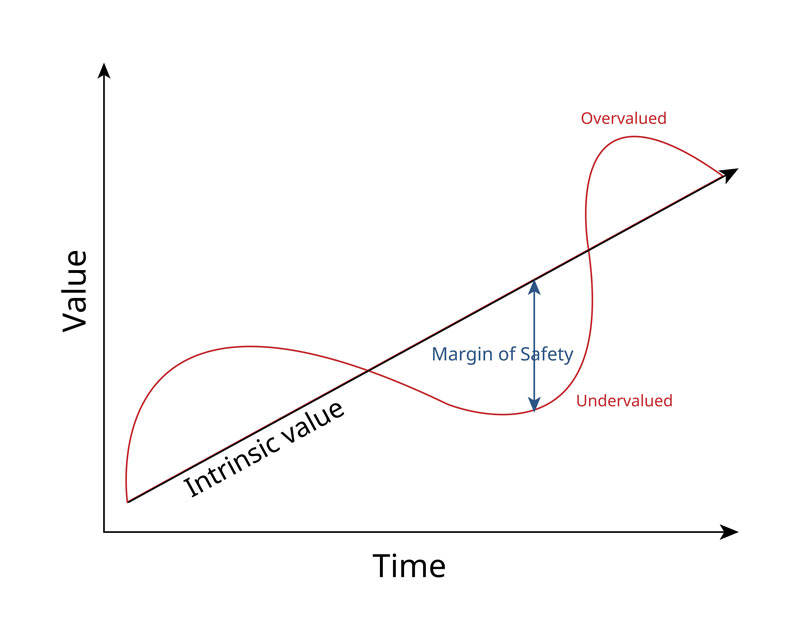

Some of you may want to shoot me if I drop this Benjamin Graham quote one more time, but I think it's important for definition's sake. The primary framework for investment is “an investment operation is one which, upon thorough analysis, promises safety of principal and an adequate return. Operations not meeting these requirements are speculative.” Like common stocks, Graham treated bonds relatively the same way. In 1934, when Graham wrote Security Analysis, it was a day and age when bond investing was the foundation of the portfolio. It’s clear in reading that the investor was to protect himself/herself from permanent loss through rigorous quality standards and, of course, generate reasonable yields. The role of bonds is that they are like an IOU. If you loan money to the issuer, and they cannot pay you back in full, and on time, well, you’re out of luck. Again, a misnomer about bonds is that they aren’t just safe by default. The quality of a bond being a safe investment comes from the borrower’s financial health. Quality over the promise. Tilting the scales in your favor with bond investing comes from the quality of the borrower, and not the promise of yield. It’s asking, is this business/government/municipality financially stable? Do they show consistent profits or tax revenues over several years? We want to seek and find if there have been any defaults or missed payments in its history.

Like common stocks and any company we buy into, we need to determine a sense of earnings protection. This brings us to discovering what is called an ‘interest coverage ratio.’ “Safety” in bond investing means we are confident that the borrower can meet interest and principal payments under adverse business conditions. The interest coverage tells you how easily a company can pay the interest on its debt. If you make $100 a month and owe $20, your coverage is five times over what is owed, which is pretty good. Now, if you make $100 and owe $50, you can only cover it two times over what is owed, making this scenario very risky.

Formula:

Interest Coverage Ratio = EBIT / Interest expense

Graham was in favor of at least a 5x buffer (before tax) when it comes to the interest coverage. This equates to about 2.9x after taxes have been taken out. Graham reiterates in Security Analysis the importance of companies that can make their principal and interest payments back to their investors through corrections and recessions. A lot of what is perceived of bonds refers to shiny object syndrome. Meaning, the investors get a list of bonds, all with their prospective yields, and we can sit back and oblige the market if we see fit. With that, yield amounts (interest payments) are labeled for the investor to see. An intelligent investor should be very cautious about what this means. Often, higher yields mean higher risk. Remember our definition above, in that we first focus on avoiding loss, and then yield is secondary. A 7% coupon that defaults leaves you worse off than a 4% bond that pays you reliably.

In the 1960s, Penn Central, a big railroad company, hung over the economy like a colossus when it came to railroads. One decade later, it went bankrupt. If the investors had paid close attention to some of the common-sense principles discussed here, they would have seen the writing on the wall. The Penn Central case is a classic example, as the company had only 1.9 times interest coverage. On top of that, the company hadn’t paid income taxes in 11 years, making the numbers even worse.

It would be a mistake to discuss bonds without mentioning interest rates. Bond prices move in the opposite direction from interest rates. When interest rates rise, existing bonds with lower coupons look less attractive, as the prices fall. When interest rates fall, existing bonds with higher coupons look more attractive, as these prices have risen. It’s a giant seesaw. Imagine you are buying a coupon for lemonade. If you have a coupon that gets you one lemonade a month and interest rates go up, the new coupons for the lemonade go to two each month. The lemonade stand has changed the deal. If you were to try and sell your coupon, people would tell you that the lemonade stand will give them more with the new coupon. The only way they will take yours is if you lower your price. On the flip side, if you bought the coupon that gets you two lemonades and interest rates go down, the new coupons the lemonade stand is giving it are for one lemonade coupon per month. In turn, people love the value of your coupon because it’s better than the new ones, and as a result, you can sell it for more money than before, meaning the bond prices went up. The critical part in understanding bonds is the ramifications of long-term holding as compared to short-term holding. If rates rise, bonds can lose value in the long term. Conversely, when interest rates fall, your other bond with a higher rate becomes more attractive and its price rises in the market.

In summary, Graham has a great quote on the relationship between bonds and interest rates. “An investor should treat the risk of interest rate changes with the same caution as the risk of default. A perfect credit quality bond can still cause loss if sold at the wrong time.”

Life is rich,

Kylan

Comments