Intrinsic Value

- Kylan Ross

- May 29, 2025

- 3 min read

When we circled back a few weeks ago to discuss the classes Warren Buffett would include in University courses, he told us he would have two. First, how to value a business, and second, how to think about markets. Over the last few weeks, we have gone over historical contexts in markets and elaborated more on the correct frameworks for investments. Today, we talk more on the topic of how to value a business. If you’ve noticed a recurring word has popped up over the last few weeks, intrinsic value. So, what does that mean? Glad you asked.

If you approached stocks in businesses as a speculator, you mainly care that the next person is willing to buy your share for more than you bought it for. As a value investor, you care more about the business in a general sense than what it's worth, not just what it costs today. This is where the intrinsic value comes in. Benjamin Graham puts intrinsic value this way: “The present value of the future earnings power of a business.” We start with the present value, which means what something in the future is worth today. It’s the notion that money received in the future is worth less than money in hand now. Part of the reason we started this series on understanding markets and historical context is that we see how it affects present values. This is due to inflation, opportunity cost, and risk. It’s essential to the investor to discount future money to determine what it’s worth today. A good example of this would be the Dollar Menu at McDonald’s. When I was in high school, I could order a cheeseburger off the menu for $1.06 with tax. Nowadays, that same burger is $2.12. This is a core idea in any valuation. It’s why $1.06 earned ten years from now is worth less than $1.06 earned today. Money received in the future will be worth less than the money in hand in the present. Future earning power is how much profit the business can generate going forward from now until judgment day. This isn’t solely evaluating last year's earnings reports (10K’s) on profits or even quarterlies (10Q’s). We need to evaluate going back 10+ years. From what I read from Graham, I am pretty sure he has gone over the financial statements for over twenty years. This enables us to look at revenue growth, profit margins, tangible assets and book value, competitive advantages, industry trends, and even the effectiveness of management. This is the company’s real worth at a present valuation, and finding out reasonably how much money it can earn over the next 10, 15, 20+ years, and then we adjust for time, risk, inflation, and uncertainty.

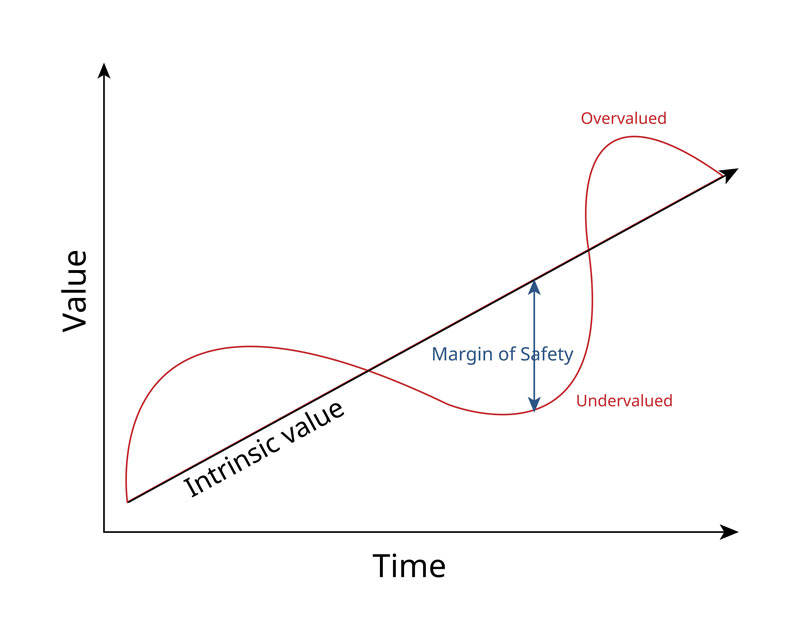

In other words, ignore the price of the stock. Find the real worth. Or as Charlie Munger puts it, “Figure out what something is worth, and pay less.” If only it were that easy, Charlie! To understand the intrinsic value of a company is to understand the business and the sector the business operates. Then we forecast the future cash flows as we have looked at the previous 10+ years of statements to reach a conservative consensus. We then discount those cash flows to the present value, and then apply a margin of safety (this is so we don’t assume perfection).

The market is not always right; in fact, it’s often wrong. Narratives change and markets fluctuate, but a solid business is well protected against the vicissitudes of the market. Matter of fact, that is a core principle of a great business is that it is well protected. After the business is understandable to us and we know it produces real profits, this anchors the investor. All that is left is a good price below what it is worth. Time will do the heavy lifting. Next week, we will dive into the calculus of getting the intrinsic value and use a real company as an example. We will also be measuring Warren Buffett and Benjamin Graham’s approach to getting these figures.

Life is rich,

Kylan

Comments