Mr. Markets Manic Episodes

- Kylan Ross

- May 8, 2025

- 4 min read

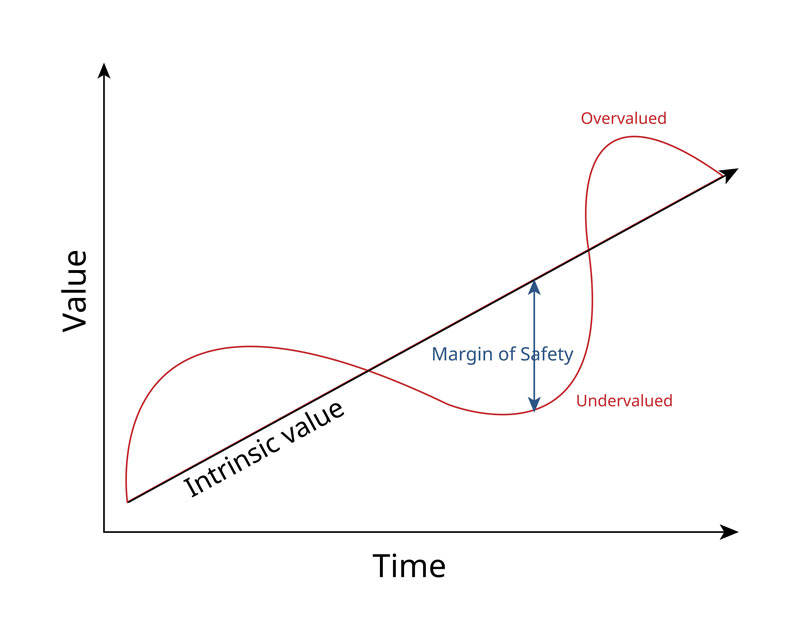

Let’s imagine for a minute that yesterday morning you decided to purchase a share in a private business. It doesn’t matter what price you paid for it, or even the terms. Because you bought a share, you have a business partner in the transaction. Let’s call him Mr. Market. Fast forward a day now, and Mr. Market shows up at your home and offers to buy your share or sell you his share at a price he chooses. Messed up, right? This example of Mr. Market is used in Benjamin Graham’s book, The Intelligent Investor. Mr. Market is emotionally unstable when it comes to measuring each business. There are days when he’s euphoric, he’s seeing growth, success, and is extremely optimistic, to which he offers you a very high price for your share. Other days, he can be anxious and depressed, worried about interest rates, crises, previous quarterly earnings, and inflation. He offers to sell his share for a dirt-cheap price, convinced that the business is done for. Some days, he’s an erratic drunk. Here’s the point: you don’t have to engage with Mr. Market. Ideally, we want to buy from Mr. Market when he is extremely pessimistic and sell our shares when he is super enthused. As Benjamin Graham says, “Mr. Market is there to serve you, not to guide you.”

We left off last week, talking about how to understand markets, and we left off at what shifts happened during the COVID-19 pandemic and onward. February 19th to March 23rd, 2020, was the fastest drop in the history of the markets, making the S&P fall 34%. I remember this time like it was yesterday, the ‘two weeks to slow the curve’ days. The panic was widespread, businesses closed, earnings collapsed, and the broader world was uncertain. Then came the rebound (hello, Mr. Market). In August of 2020, five months after the news broke out, the S&P 500 had fully recovered its previous losses and was on a fierce trajectory. The magnificent 7 (Amazon, Apple, Google, Microsoft, Facebook, Tesla, Netflix) are leading the charge. Central banks and the government took helicopters in the sky and dumped cash on the American economy with stimulus. Interest rates were low, and liquidity was way up, making retail investors (everyday investors) enter the market in masses, many through different platforms like Robinhood and Webull, to name a few. As we entered 2021, the overall market and its incumbents took a speculative journey unlike anything we have seen. Early in 2021, Reddit users on WallStreetBets coordinated a plot to inflate the price of GameStop, which was a very struggling brick-and-mortar business. In just days, the stock shot up from $20-$500. The business hadn’t changed; no fundamental value had changed within the business; it was just online hype. Later, AMC, BlackBerry, and others followed a similar trajectory. Cryptocurrencies like Dogecoin, amongst others, and NFTs were selling for more than people’s whole life insurance. The line between investing and gambling was at an all-time high. The rally that took place was a pure example of how markets can become detached from reality in the short term. This brings us to the post-pandemic era.

In 2021, the US inflation rate began climbing rapidly, reaching over 9%. This was the highest inflation since the early 1980s. A lot of this was driven by the pandemic and supply chain disruptions, but also the trillions we sprinkled from helicopters on top of the economy. The Fed reacted aggressively to what was happening by launching a steep rate hike campaign, taking interest rates up 5% in less than 18 months. Naturally, bond prices plunged as 2022-23 was the worst year for US treasuries in modern history. The speculative frenzy happening in 2020 with cryptocurrencies and unprofitable tech companies suffered as drawbacks and selloffs were happening. As Benjamin Graham says, “The intelligent investor is a realist who sells to optimists and buys from pessimists.”

After high inflation and rate hikes, the dust has started to settle. Clarity is still a bit elusive, but we are somewhat more settled. Current day Fed rates remain at +5 % as a part of a “higher for longer” stance to slow down inflation. Inflation rate, though the Fed aims to keep it at 2% per annum, is between 2.5% and 3.5%. In 2024, the S&P 500 has hovered around all-time highs, and bonds offered attractive yields for the first time in a while. “AI” has been the greatest buzzword that I can think of in the markets since the internet, but remains uncertain as to what that is going to do, and the magnitude of it. As Graham says, “The more enthusiastic the public becomes about speculative stocks, the more certain it is that the investor will be wise to keep away from them.”

As we can see, Mr. Market is erratic at times. He’s either the long-lost drunk uncle at the Christmas gathering or a cheerful giver. Use your due diligence and judgment to see what he is offering you. You want to keep calm in a haywire environment like the last 5 years we have just experienced. While AI has merit, I would be cautious. Chasing companies that have a bad track record (or are a new entrant), but a glorious future, is probably not a great investment. My take on AI is that it has built itself up as a 'get-rich-quick' scheme with investors. At the top of the AI chain is a bunch of people all trying to outsmart one another in hopes of attracting more money. As an investor, that is a dumb game to play. As an intelligent investor, you want to separate the revolution from the overvaluation. You would rather get rich for certain than get-rich-quick. Mr. Market is a good salesperson and an even better liar. Remember, the market is there to serve you, not to instruct you.

Life is rich,

Kylan

Comments