Tariff-ic Times: Tariffs, Tweets & Tumbles

- Kylan Ross

- Apr 10, 2025

- 6 min read

For most of us who have been paying attention this week, we have been tuning into what the new administration plans to roll out for trade policy, and tariffs. Tariffs have historically played a key initiative in trade policy in the United States. Throughout our nation's history, we have done this through two main ideas. First, what is called 'protectionism 'is a political idea that means a policy to restrict imports from other countries to help domestic industries. The second way, we engage in trade is through 'free trade' meaning the US Government does not hinder imports or exports by applying tariffs. Free trade doesn't mean its 'free' rather it's just inexpensive. A tariff is a tax on imported goods.

From the beginning of the 19th century until the mid-20th century, the United States pursued a 'protectionist' policy. Matter of fact, from 1861 to 1933 the United States had one of the highest average tariff rates of manufactured imports in the world. This protectionist approach had significant and varied impacts on the US Economy. During this period the United States maintained some of the highest tariff rates globally, exceeding 50% on manufactured goods across averages. The steel industry, for instance, benefited greatly which led to substantial increases in production and technological advancements. By 1897, American Steel prices had become competitive globally which made exporting steel to other countries profitable. Ok... so is there bad news? Yes. The 'Hoover Institution' published an article explaining how during this time period the United States created 'lower labor productivity.' Think of it this way... Imagine people started building mattress factories in America because they didn't have to compete with other countries. These factories turned a profit, and hired and employed lots of individuals - Great! But, many of those mattress manufacturers were small and not the greatest at making mattresses quickly, or efficiently. With that, the tariff on imported mattresses coming into the states protected the mattress factories. Because of this, the productivity of some manufacturers made it to where there wasn't much reason to get better, hence the term 'lower labor productivity.' In sum, tariffs helped create more manufacturing jobs, but possibly at the cost of having smaller, less efficient factories that didn't have to improve with the globe at large.

In 1942 free trade was being promoted by the United States in the middle of a WWII era. The idea was to make goods cheaper to produce and make them more competitive in the International market. The goal was to increase exports and thus prosperity to our Allies amidst the war. By reducing the trade barriers with allies, this made it easier to supply goods. Still, there were some downsides. In the middle of a war, depending on goods from other nations creates anxiety and fear among the importer. Especially when your trade route is preoccupied by enemy lines. To fully articulate the impacts of tariffs at the start you have to start at the extremes. Being that we are talking about tariffs amidst war that is an extreme scenario but one worth talking about. In peaceful times, free trade often means cheaper foreign goods can undercut US producers. During war, most of the US industries were focused on military production. Free trade can be great so long as there are checks and balances, as sometimes it's better to keep things close to home.

So what has Trump and his team put forth and what's the controversy? Aside from the markets falling (more on this next week) we take a look at the policies that have your left-winged cousins marching in the streets and conservatives tip-toeing in their Jordans. Regardless of political affiliation, these policies introduce a broad and aggressive tariff structure differentiating themselves from any other tariffs seen before. In the 1930's the Smoot-Hawley Tariff Act raised tariffs on 20,000 goods during the Great Depression to "protect" American jobs. This was deemed as a backfire due to 30 other countries retaliating, world trade collapsed and many economists believe it worsened the Great Depression globally. It was after these tariffs it became a cautionary tale that high, broad-based tariffs can spiral economic pain. In the early 21st century Barack Obama used retaliatory tariffs at a small scale in order to charge countries for charging tax on its exports. Trump's first term (2017-2020) began challenging the free-trade consensus with tariffs on steel, aluminum, and Chinese goods. These were mostly selective and not as overkill. This takes us to "Liberation Day." The Dow, the Don, and the Era of Protectionism. Unlike Trump's original tariffs that were industry-specific, Trump's new plan applies a universal baseline 10% tariff on nearly all imports as of late last week. 'Liberation Day' makes it different than any tariff policy we have seen this last century. It raises the average U.S. tariff rate to 23%, levels unseen since the 1800's and 1920's. However, Trump on Wednesday, April 9th opened with new updates for the public and the markets at large placing a 90-day pause on reciprocal tariffs with the exception to China. This helped lighten the load of the initial announcement made on April 2nd.

ERA | Tariff Style | Goals | Global Impact | Avg. Tariff Rates |

1800s (pre-1913 *income tax) | High & Protective | Build industries, fund government | Protectionist | 20-50% (varied over decades) |

1930’s (Great Depression Era) | Smoot-Hawley | Protect Jobs during the Great Depression | Backfired- Global trade collapse | 59% (1932 peak) |

Post-WWII (1945-1980s) | Lowered Tariffs | Global Peace & Prosperity | Growth of Free Trade | 5-10% (declining over decades) |

1990s-2000s (NAFTA/WTO era) | Low, open trade | Increase efficiencies, consumer choice | Free trade to become global norm | 2-4% |

2018-2020 | Selective Trump Tariffs | Trade Balance | China Retaliation, WTO Tensions | 3-5% (spiked on some goods) |

Liberation Day (April 2nd, 2025) | Broad, nationalist tariffs | Economic nationalism, self-reliance, reduce imports | Potential global trade war, inflation risk | 23% average |

Trump's stance has been strong. Communicating that it's not about just fixing unfair trade but rather a push for economic independence. So where do we land? Last, but certainly not least there is one more metric that is arguably the most important to look at, revenues. In the early 19th century, tariffs accounted for over 80% of total government revenue. Between 1861 and 1865 (Civil War) the US generated about 43% of federal tax revenue from goods imported from other nations. In the early 20th century, the introduction of the income tax in 1913 began reducing the heavy reliance on tariffs. In 1915, tariffs contributed toward 30.1% of federal revenues. The 1930s era sought a bunch of challenges due to the Great Depression, experiencing a decline in federal revenues. Accounting around 9.5% of federal revenues during that decade. Many economists don't explicitly blame tariffs for the struggles of the depression as the depression started before strict tariffs were set in place. Naturally, this led to reduced import activity and diminishing the base on which tariffs were applied. Post WWII and the emphasis on free trade, tariffs became a minor part of federal income due to the focus on reducing trade barriers. Tariff revenues average out to 1.9% and that rate pretty much continued until Trump's first term where tariffs generated 34.6 billion, about 1% of federal revenues.

I know—there's a lot here. So, where do we draw our consensus? There are no certain or safe answers regarding global economics. Trump's administration thinks that tariffs will generate revenues between 3 and 6 trillion dollars over a ten-year span, which would average out to 300 to 600 billion annually. In my own head, I feel a little bit like Alan in The Hangover.

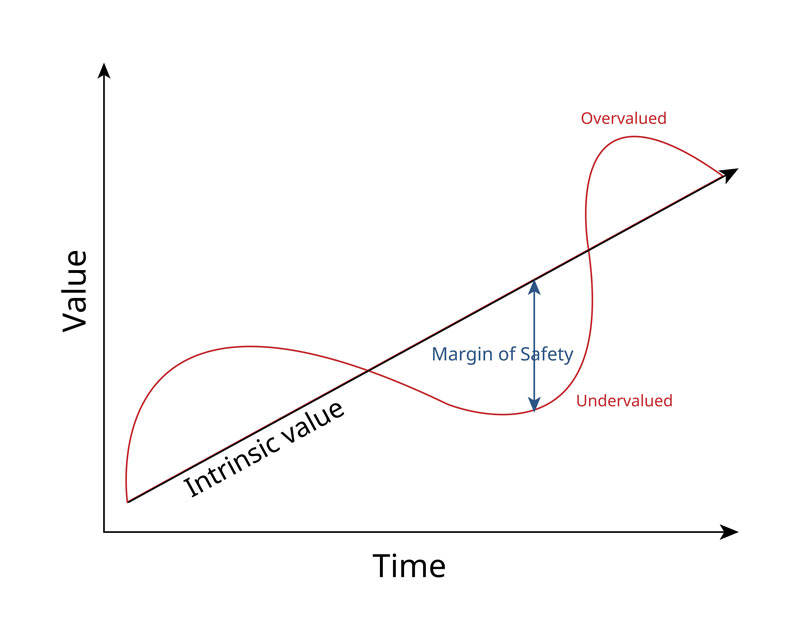

The reason I dive into the history of tariffs is because they tell a story. We learn from history, where to go, and where to never to turn back to. My honest opinion of the whole thing is that I think the goal of what Trump wants to do is not a bad goal. The US, behind Japan is the second most free-trade market in the world. Why are we not 10th, or 12th on that list? I think the policies that have been in place since the end of WWII are not fit for today. The overall goal to reset our trade policy seems smart. The messaging (like most things Trump does) is not how I would do it. It can create uncertainty in the short-term which we have seen a lot this last week. Second, it can create a correction and increase chance for market volatility. By the way, these may seem negative but they could be the very correction we need - especially for young people (more on this next week). Since the inauguration day our interest rates have been lower, and the S&P 500 index is cheaper, which is appropriate. Overarchingly, I think the US stands at a good place right now. Unemployment is at 4% which is historically good, 200,000+ new jobs have been added, and massive investments like TSMC are coming to the states. If there is one thing I have noticed in my own life it's this notion that nothing is ever as good, or bad as it seems. Aside from weapons of mass destruction, we do know that for the United States over the medium to long term everything flows up and to the right. Business evolves, things change, and yet, we are still the most prosperous nation in human history. So when we hear the bad news, remember that there is power in pausing. To not make panicked, irrational, quick decisions. I think Charlie Munger calls that, 'temperament.' Thanks, poor Charlie. For the rest of us, slowing down, and being rational will do.

Life is rich,

Kylan

Comments