Value Investing & Its Evil Twin

- Kylan Ross

- Apr 24, 2025

- 4 min read

If you've been in the markets for a certain period of time, you've probably heard of the phrase 'value investing' before. In last week's Capital Compass article, we talked a little bit about value investing and its evil twin, speculation. The father of value investing is none other than Warren Buffett's mentor figure, Benjamin Graham. Graham defines value investing as "an investment operation that, upon thorough analysis, promises safety of principal and a satisfactory return. Operations not meeting these requirements are speculative." Graham breaks down his methodology of value investing as having less to do with IQ or even SAT scores but rather temperament. Having the ability to be patient and disciplined, harnessing your emotions, and thinking rationally. He explains this as more of a trait of character than of the brain. That being said, you do need some brains to find which investments make the most sense.

Defensive investing seeks safety and simplicity while maintaining minimal effort. The goal is having stability and peace of mind. By the way, this is not wrong in the slightest, and I feel that most people land somewhat in this category. Diversification, as I said last week, is a defensive strategy, and defense wins championships. This strategy is for long-term investors who aren't interested in deep analysis. Defensive investing can look like a multitude of different investment types, such as working with a financial advisor, ETFs, blue-chip stocks, mutual funds, and high-grade bonds. There is a big misnomer in the markets (usually by speculators) that you shouldn't diversify and that instead you should go all in on one thing! Unless you have the required skillset to analyze and look at the balance sheets, income statements, and cash-flow statements of companies, all while finding their competitive advantage, you are fine landing into a defensive investing approach.

Speculation, on the other hand, is buying businesses, stocks, bonds, etc. without analysis or buying off of market hype and emotion. This looks like chasing trends, trying to time the market, and emotional reactions to news and price fluctuations. These often disguise themselves as being overconfident and underinformed. Graham puts speculation this way: "The speculator's chief enemies are always optimism, greed, fear, and lack of discipline." Speculation is not investing; it's going to the casino. These are your 'yolo everything into Gamestop and see it go up!' Remember that any time you are on the internet and some Joe Schmo is talking about their gains, there is another group who lost everything in the markets off the same trade. Graph illustration below:

Type of Investor | Effort Level | Key Focus | Risk Tolerance | Strategy |

Defensive | Low | Capital Preservation | Low | ETF’s, Mutual Funds, high-grade bonds |

Enterprising (also known as ‘value investing’ or ‘intelligent investor’) | High | Value and mispricing | Medium | Deep, thorough analysis; special situations. Think of stocks as buying businesses. |

Speculative | Emotional | Price movements, Hype | High | Trend chasing, market timing |

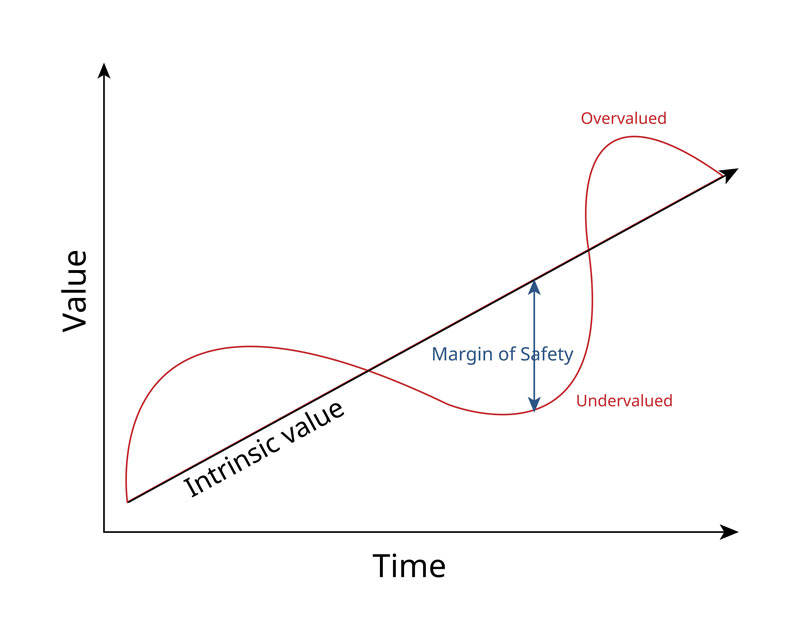

So, why is knowing different investing profiles important? Simple; these set up an investing framework for you to work with. Rule #1 with investing is to not lose money. Rule #2 is to not forget Rule #1. A true meaning of an investor is that you focus on the long term. Back in the late 1990s, dot-com stocks seemed to be doubling in value every day. Wall Street at that time thought that everything they poured into the market was bound to go up, and the thought of losing your money seemed absurd. Fast forward to the end of 2002, and many of the telecom and dot-com stocks had lost 95% of their value! That would mean you would have to gain 1,900% just to get back to where you started. Amazon at the peak of the dot-com era saw its stock price get up to $113. As soon as that bubble burst open, it went down to $6 in less than a year. This doesn't mean that price fluctuations don't happen; they do every single day. Benjamin Graham, through his writings, has taught me to emphasize the importance of avoiding losses, and you don't take losses if you don't sell. The Value Investor (Enterprising) framework looks at the companies intrinsic value when investing. According to Warren Buffett, "Price is what you pay. Value is what you get." What he means by that is the stock price may be high or low, but what matters is whether you're getting more value than you paid for. It's the true worth of a business based on the money it will make from now until judgment day. It is not based on stock price, hype, or recent trends; it's about what the business is actually earning and how much of it comes back to you as the investor. You would go through the financials if you were going to purchase a multi-family unit, a farm, a gas station, etc. But why is it that when people buy individual stocks (businesses), they don't take that same philosophy? It's an investment; it needs to be paid attention to. The questions should resemble some of the following: Has the company grown its earnings in the last 10+ years? What will the company earn in the next 5, 10, or 30 years from now? How much are those future dollars worth today? Is the company durable? Can it maintain its earnings power long-term? Does this company have a competitive advantage in the market compared to its competitors? Does the company pay a dividend? These are all great questions to ask and figure out when looking at buying businesses.

Intrinsic value lets you know what a business is truly worth and is a hedge against overpaying. If a stock is being sold below the intrinsic value, it leaves a margin of safety for the investor. To purchase a stock above, you are likely betting and speculating. Warren Buffett puts it this way: "Never count on making a good sale. Have the purchase price be so attractive that even a mediocre sale gives good results." I want you to win. Part of winning is small wins in your sail, and the best way to make good money in the markets is to start by making a little. After all, the compound effect from 30 years in the market will do its job. In the meantime, we keep learning, and we keep adapting.

Life is rich,

Kylan

Comments